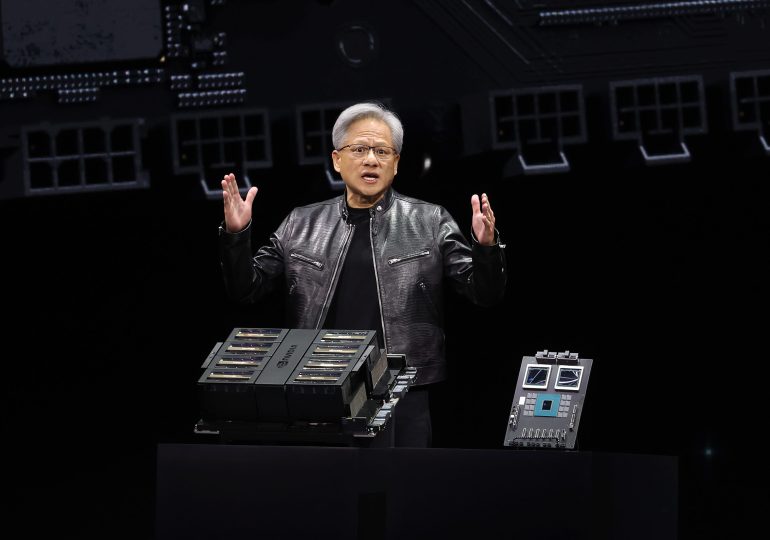

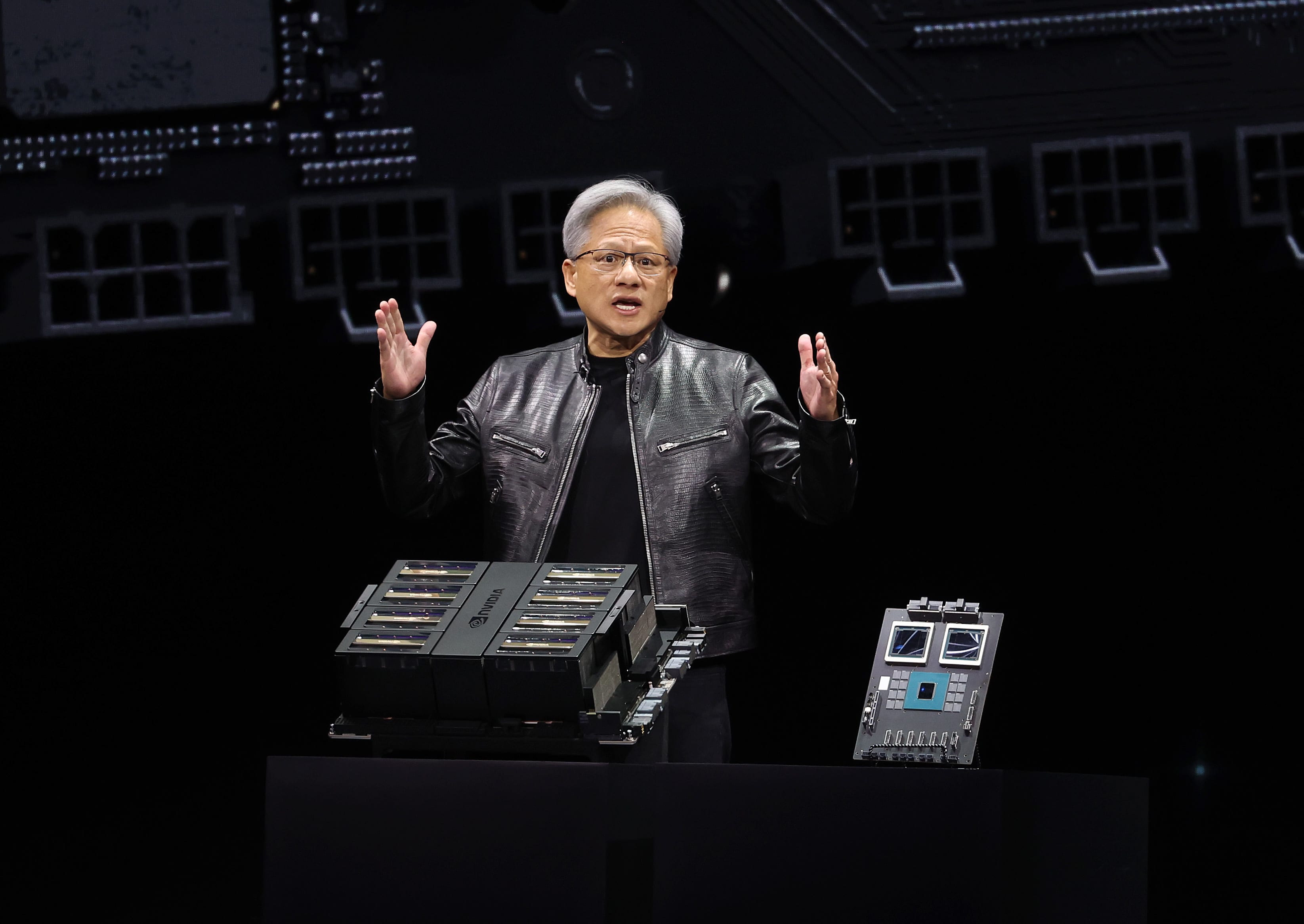

Nvidia CEO Jensen Huang delivers a keynote address during the Nvidia GTC Artificial Intelligence Conference at SAP Center on March 18, 2024 in San Jose, California.

Justin Sullivan | Getty Images

Nvidia’s share price is up five-fold and total sales have more than tripled since OpenAI’s ChatGPT kicked off the AI boom in late 2022. Nvidia’s high-end server GPUs are essential for training and deploying large AI models. Companies like Microsoft and Meta have spent billions of dollars buying the chips.

The new generation of AI graphics processors is named Blackwell. The first Blackwell chip is called the GB200 and will ship later this year. Nvidia is enticing its customers with more powerful chips to spur new orders. Companies and software makers, for example, are still scrambling to get their hands on the current generation of “Hopper” H100s and similar chips.“Hopper is fantastic, but we need bigger GPUs,” Nvidia CEO Jensen Huang said on Monday at the company’s developer conference in California.

Nvidia shares fell more than 1% in extended trading on Monday.

The company also introduced revenue-generating software called NIM that will make it easier to deploy AI, giving customers another reason to stick with Nvidia chips over a rising field of competitors.

Nvidia executives say that the company is becoming less of a mercenary chip provider and more of a platform provider, like Microsoft or Apple, on which other companies can build software.

“Blackwell’s not a chip, it’s the name of a platform,” Huang said.

“The sellable commercial product was the GPU and the software was all to help people use the GPU in different ways,” said Nvidia enterprise VP Manuvir Das in an interview. “Of course, we still do that. But what’s really changed is, we really have a commercial software business now.”

Das said Nvidia’s new software will make it easier to run programs on any of Nvidia’s GPUs, even older ones that might be better suited for deploying but not building AI.

“If you’re a developer, you’ve got an interesting model you want people to adopt, if you put it in a NIM, we’ll make sure that it’s runnable on all our GPUs, so you reach a lot of people,” Das said.

Meet Blackwell, the successor to Hopper

Nvidia’s GB200 Grace Blackwell Superchip, with two B200 graphics processors and one Arm-based central processor.

Every two years Nvidia updates its GPU architecture, unlocking a big jump in performance. Many of the AI models released over the past year were trained on the company’s Hopper architecture — used by chips such as the H100 — which was announced in 2022.

Nvidia says Blackwell-based processors, like the GB200, offer a huge performance upgrade for AI companies, with 20 petaflops in AI performance versus 4 petaflops for the H100. The additional processing power will enable AI companies to train bigger and more intricate models, Nvidia said.

The chip includes what Nvidia calls a “transformer engine specifically built to run transformers-based AI, one of the core technologies underpinning ChatGPT.

The Blackwell GPU is large and combines two separately manufactured dies into one chip manufactured by TSMC. It will also be available as an entire server called the GB200 NVLink 2, combining 72 Blackwell GPUs and other Nvidia parts designed to train AI models.

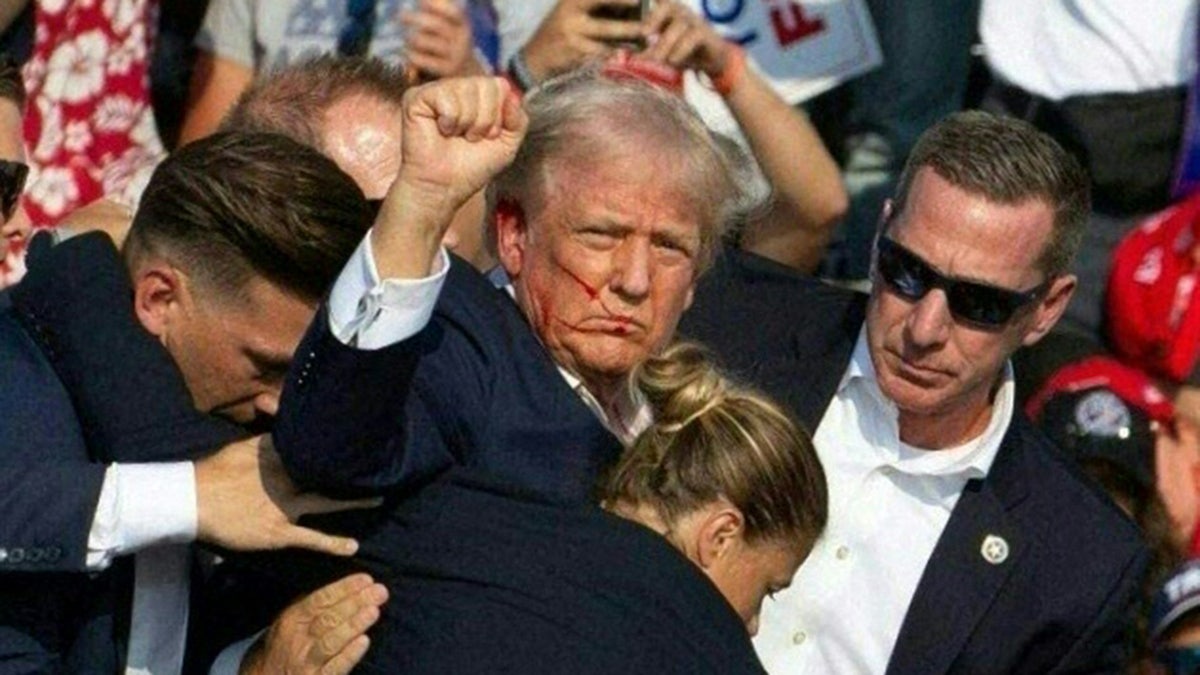

Nvidia CEO Jensen Huang compares the size of the new “Blackwell” chip versus the current “Hopper” H100 chip at the company’s developer conference, in San Jose, California.

Nvidia

Amazon, Google, Microsoft, and Oracle will sell access to the GB200 through cloud services. The GB200 pairs two B200 Blackwell GPUs with one Arm-based Grace CPU. Nvidia said Amazon Web Services would build a server cluster with 20,000 GB200 chips.

Nvidia said that the system can deploy a 27-trillion-parameter model. That’s much larger than even the biggest models, such as GPT-4, which reportedly has 1.7 trillion parameters. Many artificial intelligence researchers believe bigger models with more parameters and data could unlock new capabilities.

Nvidia didn’t provide a cost for the new GB200 or the systems it’s used in. Nvidia’s Hopper-based H100 costs between $25,000 and $40,000 per chip, with whole systems that cost as much as $200,000, according to analyst estimates.

Nvidia will also sell B200 graphics processors as part of a complete system that takes up an entire server rack.

Nvidia inference microservice

Nvidia also announced it’s adding a new product named NIM, which stands for Nvidia Inference Microservice, to its Nvidia enterprise software subscription.

NIM makes it easier to use older Nvidia GPUs for inference, or the process of running AI software, and will allow companies to continue to use the hundreds of millions of Nvidia GPUs they already own. Inference requires less computational power than the initial training of a new AI model. NIM enables companies that want to run their own AI models, instead of buying access to AI results as a service from companies like OpenAI.

The strategy is to get customers who buy Nvidia-based servers to sign up for Nvidia enterprise, which costs $4,500 per GPU per year for a license.

Nvidia will work with AI companies like Microsoft or Hugging Face to ensure their AI models are tuned to run on all compatible Nvidia chips. Then, using a NIM, developers can efficiently run the model on their own servers or cloud-based Nvidia servers without a lengthy configuration process.

“In my code, where I was calling into OpenAI, I will replace one line of code to point it to this NIM that I got from Nvidia instead,” Das said.

Nvidia says the software will also help AI run on GPU-equipped laptops, instead of on servers in the cloud.